In a market environment where logic often takes a back seat to liquidity, sentiment, and narrative, doge coin has once again found its way back into serious trading discussions.

Once dismissed as nothing more than a joke, doge coin is showing renewed signs of life after an extended period of sideways consolidation. What was once considered “dead money” is now quietly rebuilding momentum, prompting traders to ask a different question—not whether doge coin can move again, but how far it could realistically go in the next cycle.

While traditional investors remain focused on earnings multiples, yield curves, and balance sheet stress in legacy markets, crypto traders are once again watching the Shiba Inu. And this time, the technical structure, volume behavior, and broader market context suggest the joke may once again be on the skeptics.

From Meme to Market Instrument: How Doge Coin Trades in Reality

To understand doge coin, one must abandon conventional valuation frameworks. This asset does not move on discounted cash flows or network revenue models. Instead, doge coin trades on three primary forces:

- Liquidity cycles

- Market psychology

- Narrative rotation

In previous bull markets, doge coin repeatedly demonstrated a clear behavioral pattern: prolonged consolidation followed by sudden, explosive upside once risk appetite returned. These moves often occurred after Bitcoin and Ethereum had already begun trending higher, positioning doge coin as a late-cycle momentum amplifier.

As broader crypto liquidity improves, forecasts for doge coin are being quietly revised upward. Even quantitative desks now acknowledge that meme assets have become structurally embedded in market behavior, not anomalies.

Historically, once doge coin establishes a higher price floor, it tends to overshoot expectations during momentum phases. This dynamic is once again beginning to emerge.

Liquidity Is the Real Fuel Behind Doge Coin Moves

Crypto markets remain deeply liquidity-driven, and doge coin is among the most sensitive assets to shifts in capital flow.

When liquidity expands:

- Volatility increases

- Retail participation rises

- High-beta assets outperform

Doge coin consistently ranks among the highest beta instruments in the digital asset space. During prior cycles, it delivered returns that vastly exceeded larger-cap assets—albeit with higher risk.

As traders rotate capital outward from large-cap crypto into speculative plays, doge coin historically becomes a primary beneficiary. This does not require universal optimism; it only requires enough marginal buyers chasing momentum.

Technical Structure: Why the Doge Coin Chart Is Drawing Attention Again

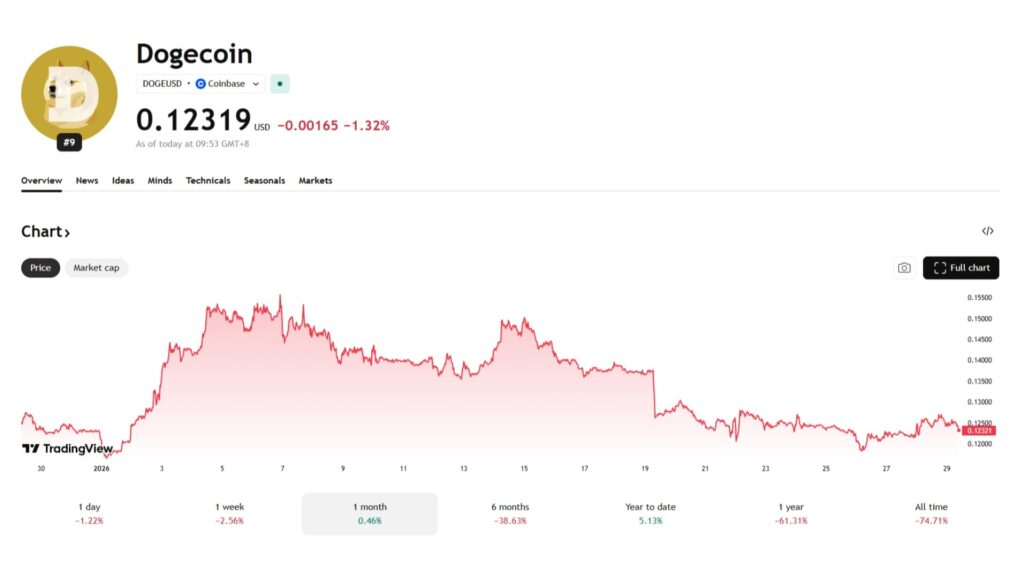

Technical analysis on meme assets is often mocked, yet time and again price action proves otherwise. Doge coin’s current structure shares notable similarities with prior pre-breakout phases.

Momentum Indicators Are Re-Engaging

Key oscillators such as RSI and MACD are no longer flatlining. Instead, they are gradually turning upward from neutral zones—an early sign that selling pressure has been absorbed.

In past cycles, this exact configuration preceded aggressive upside expansions in doge coin. While indicators alone are never sufficient, their alignment with price compression increases probability.

Support Has Proven Resilient

Repeated tests of major support zones failed to produce breakdowns. Each attempt by sellers was absorbed, suggesting that stronger hands are accumulating rather than distributing.

This behavior indicates that downside risk may be increasingly limited relative to upside potential—an attractive asymmetry for speculative traders.

Compression Signals Energy Buildup

Extended periods of low volatility often precede sharp directional moves. Doge coin’s current price action reflects precisely this kind of compression.

Once price clears a key resistance zone, historical precedent suggests that follow-through can be swift and disorderly, driven by short covering and momentum chasing.

Volume Tells the Story Before Price Does

Volume remains one of the most reliable leading indicators in any market. Recent doge coin trading activity shows a gradual but consistent increase in participation.

This is not the erratic spike associated with hype-driven pumps. Instead, it reflects steady accumulation:

- Rising volume on green candles

- Lower volume on pullbacks

- Improving order book depth

Such behavior typically signals positioning ahead of a larger move rather than reactive speculation.

As volume builds, market psychology shifts. What begins as cautious interest often evolves into fear of missing out once price accelerates.

The Social Narrative Still Matters—More Than Many Admit

Despite increased institutional participation in crypto, doge coin remains deeply narrative-driven.

Social engagement, online discourse, and community sentiment continue to exert measurable influence on price behavior. Unlike smaller meme tokens, doge coin benefits from unmatched brand recognition and longevity.

The so-called “Elon factor” remains an ever-present wildcard. While markets are no longer solely dependent on social media catalysts, history shows that doge coin is uniquely reactive to high-visibility commentary.

That said, current market structure suggests that doge coin no longer requires external hype to move. If sentiment aligns with technical confirmation, upside can develop organically.

Risk Appetite and the Macro Backdrop

Broader macro conditions also play a role. In periods where traditional assets appear fully priced or fragile, speculative capital often seeks alternative outlets.

Crypto, by design, absorbs excess risk appetite—and within crypto, meme assets like doge coin represent the extreme end of that spectrum.

As monetary policy expectations stabilize and liquidity conditions improve, traders increasingly allocate a portion of capital toward asymmetric opportunities.

Platforms like Ultima Markets offer access to a wide range of instruments for traders seeking diversified exposure across market regimes, including high-volatility environments.

Strategy Matters: Observing vs. Chasing Doge Coin

The prevailing sentiment among experienced traders is not blind enthusiasm, but conditional optimism.

Rather than chasing price, disciplined participants focus on:

- Breakout confirmation

- Retests of reclaimed resistance

- Volume expansion validation

Understanding how doge coin behaves during different volatility regimes is essential before committing capital.

Why Doge Coin Still Commands Attention in 2026

Doge coin has outlived countless critics. Each cycle brings new skepticism, yet the asset continues to reassert itself when conditions align.

Its strength lies not in innovation, but in:

- Cultural persistence

- Liquidity depth

- Reflexive market behavior

As long as crypto markets reward momentum and narrative, doge coin remains relevant.

For traders looking to deepen their understanding of market psychology and macro-driven setups, you can always learn more through structured market insights and analysis.

Conclusion

Doge coin does not need to make sense to work. It never has.

What matters is structure, liquidity, and timing—and all three are beginning to align once again. While risks remain elevated, the current setup suggests that doge coin may be transitioning from dormancy into a new phase of expansion.

For traders who thrive on volatility and understand the mechanics of speculative cycles, doge coin deserves attention—not blind faith, but informed observation.

FAQ

Q1: Is doge coin still considered a meme asset?

Yes, but it has evolved into a liquidity-driven trading instrument with recurring cyclical behavior.

Q2: Does doge coin follow Bitcoin movements?

Historically, doge coin tends to lag Bitcoin before outperforming during later stages of bullish cycles.

Q3: Is volume important when trading doge coin?

Absolutely. Volume often precedes major price moves and helps validate breakouts.

Q4: Is doge coin suitable for long-term holding?

Doge coin is best approached as a high-volatility asset rather than a traditional long-term investment.

Q5: Can beginners trade doge coin safely?

Beginners should first observe behavior using demo environments and strict risk management.

This article represents the author’s personal views only and is for reference purposes. It does not constitute any professional advice.