Copper has entered a powerful bullish phase, with prices climbing toward $5.19 per pound in late November 2025—levels not seen in several months. This renewed momentum is driven by a widening structural supply deficit, persistent disruptions at major mining sites, and resilient demand expectations from global manufacturing and electrification sectors. As copper trades near the $5.20 resistance region, market sentiment suggests the strength may continue, barring major macroeconomic or geopolitical surprises.

To better understand copper’s trajectory, this analysis examines the fundamental supply imbalance, technical market structure, and broader macro trends influencing traders, including those using platforms like Ultima Markets or those practicing strategies through a risk-free demo account. For readers who want a deeper dive into market behavior, you can also learn more through additional research resources.

A Global Copper Shortage Deepens: Supply Disruptions Intensify

Copper’s price strength is rooted in a notable global supply contraction, one that analysts now consider a multi-year structural deficit. A series of high-impact disruptions has contributed to this imbalance, reshaping what was once expected to be a surplus into a persistent shortage through 2026 and beyond.

Major Mine Closures Reshape the 2025–2026 Outlook

The most disruptive development this year was the shutdown of Indonesia’s Grasberg mine, the world’s second-largest copper operation. A deadly mudslide halted production and triggered force majeure, removing an estimated 591,000 metric tons from global supply until at least December 2026. This event alone has rewritten the global copper balance, shifting expectations dramatically.

Meanwhile, Chile’s Quebrada Blanca Phase 2 project has encountered operational setbacks that reduced its expected output. Combined with declining ore grades across multiple regions, permitting delays, and environmental constraints, global refined copper output growth has been revised downward:

- 2025: 1.2% (previously projected above 2%)

- 2026: 2.2% (potentially lower if disruptions persist)

Instead of a previously projected 209,000-ton surplus for 2026, analysts now forecast a 150,000-ton shortage—a remarkable reversal.

These challenges suggest supply will struggle to keep pace with accelerating demand from renewable energy, EV manufacturing, and power grid upgrades. As a result, traders exploring a trading account may find copper increasingly attractive as a long-term strategic asset.

Record Price Forecasts from Global Institutions

Chile’s state copper commission, Cochilco, recently raised its forecast to:

- $4.45 per pound for 2025

- $4.55 per pound for 2026

This marks the most bullish projection in the commission’s history and reflects growing confidence that copper’s supply issues will persist through the decade. The outlook through 2030 suggests limited new capacity will come online to balance the deficit.

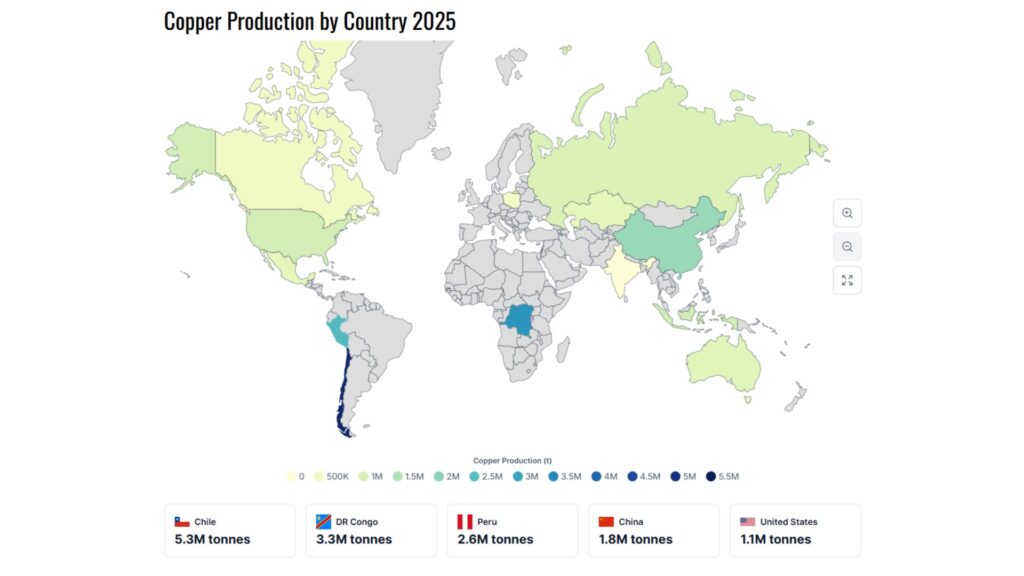

Source: World Population Review

Technical Analysis: Bulls Maintain Control as Copper Tests Multi-Month Highs

Beyond fundamentals, copper’s technical structure reinforces the bullish sentiment, with multiple indicators pointing toward extended gains.

Copper Price Momentum Strengthens

Copper has rallied from a September low near $4.50 to the current $5.10–$5.19 range. The recovery has been steady, supported by improving momentum and buying pressure across futures markets.

Key technical highlights include:

- Renko charts show a stable upward progression after months of consolidation.

- The MACD histogram recently crossed into positive territory, suggesting the beginning of a sustainable trend.

- Stochastic oscillators show strong rebounds following brief pullbacks, indicating continued interest from buyers.

- The $4.95–$5.00 zone has held as firm support, with multiple successful defenses in October and November.

If copper breaks the crucial $5.20 resistance, momentum could rapidly push prices toward $5.50, particularly if the Federal Reserve introduces rate cuts that boost industrial and commodity markets.

Macroeconomic and Industrial Trends Supporting Copper’s Uptrend

Although copper’s supply-side constraints are well understood, macroeconomic trends also play a critical role in shaping its price trajectory.

Electrification and Renewables Drive Structural Demand Growth

Global demand for copper is anchored by accelerating investment in:

- Electric vehicle (EV) manufacturing

- Solar and wind power infrastructure

- Data centers and AI-driven electricity expansion

- Power grid modernization

EVs alone require 2–4x more copper than traditional vehicles, while renewable energy systems remain heavily copper-dependent.

By 2030, global copper demand is expected to grow by 30%, according to major research institutions.

Manufacturing Recovery Across Asia and North America

Recent leading indicators show stabilizing PMIs across:

- The United States,

- China,

- India,

- Southeast Asia,

providing further support for industrial metals. Chinese manufacturing in particular—long a central driver—continues to influence global copper flows, with government stimulus policies adding upward pressure.

U.S. Policy Impact and Dollar Trends

Copper prices are also sensitive to:

- Federal Reserve interest rate decisions

- Dollar index movements

- U.S. infrastructure spending initiatives

A weaker USD tends to push copper higher, while rate cuts could stimulate manufacturing and construction activity worldwide.

Are There Risks Ahead? Key Factors to Watch

While copper’s outlook appears constructive, traders should remain cautious of potential headwinds.

Economic Slowdowns Could Temporarily Ease Demand

If global GDP growth falls below expectations, copper consumption—particularly in construction and heavy manufacturing—could weaken.

Inventory Levels Remain Volatile

LME and Shanghai inventory data remain historically tight, but any significant increases could soften bullish momentum.

Geopolitical Risks

Copper supply routes are vulnerable to:

- Strikes in Latin America

- Environmental protests

- Transport disruptions

These may either accelerate the rally (if supply is restricted) or cause broader market instability.

Summary

Copper’s performance in 2025 has been exceptionally strong, with year-to-date gains above 31%. The combination of tight supply, structural deficits, and firm long-term demand offers compelling support for further price appreciation through 2026.

However, traders should remain attentive to:

- Federal Reserve policy changes,

- Chinese industrial activity,

- Production updates from key mines, and

- Inventory movements across major exchanges.

For those who wish to explore copper trading strategies or test positions risk-free, a demo account can provide valuable hands-on experience. More advanced traders may consider opening a dedicated trading account to capture potential opportunities in the market.

FAQ

1. Why are copper prices rising so quickly in 2025?

Copper prices are being driven higher by severe supply disruptions, including major mine shutdowns, declining ore grades, and reduced production forecasts for 2025 and 2026.

2. Will copper remain in a supply deficit through 2026?

Yes. Current projections indicate a shortage of around 150,000 tons in 2026, reversing earlier surplus forecasts.

3. Is copper still sensitive to Federal Reserve decisions?

Absolutely. A shift toward rate cuts could boost global manufacturing demand, supporting copper prices.

4. What is the next key resistance level for copper?

The $5.20 level is the current major barrier. A breakout could open a path toward $5.50.

5. How can traders gain exposure to copper markets?

Platforms like Ultima Markets offer copper trading via CFDs, allowing traders to speculate on both rising and falling prices.

This article represents the author’s personal views only and is for reference purposes. It does not constitute any professional advice.