The CHF (Swiss Franc) has reasserted its status as one of the world’s most reliable safe-haven currencies, delivering a powerful rally that reshaped global FX markets through 2025 and into early 2026. Against the US dollar, the CHF appreciated by approximately 13–15% in 2025, pushing USD/CHF below the critical 0.8000 threshold for the first time in years.

This move is not the result of a single catalyst. Instead, the CHF’s strength reflects a convergence of geopolitical risk, declining confidence in US institutional stability, and a global shift toward capital preservation over yield. As uncertainty dominates macro narratives, the CHF continues to attract inflows from investors prioritizing safety, credibility, and long-term monetary discipline.

Why the CHF Matters in Today’s FX Landscape

The CHF occupies a unique position in global currency markets. Switzerland’s political neutrality, strong fiscal discipline, and consistent current account surplus have historically insulated the CHF from external shocks. During periods of global stress, capital tends to flow into CHF-denominated assets regardless of yield considerations.

As we enter 2026, this dynamic has intensified. The CHF is no longer just benefiting from external crises—it is also gaining strength due to relative deterioration elsewhere, particularly within the US political and institutional framework.

For traders and long-term investors alike, understanding the CHF’s momentum is essential for navigating risk-off environments and adjusting portfolio exposure accordingly.

Geopolitical Risk as a Catalyst for CHF Demand

The most immediate driver behind the CHF surge has been a renewed escalation in global geopolitical tensions. As risk appetite deteriorates, investors instinctively rotate toward safe-haven currencies, and the CHF stands at the top of that hierarchy.

In early January 2026, heightened instability in the Middle East reignited global risk aversion. Statements from US leadership warning Iran over domestic unrest—paired with counter-warnings from Tehran against foreign intervention—created a volatile geopolitical backdrop. Markets reacted swiftly, with capital flowing into the CHF as uncertainty spread across risk assets.

A second wave of CHF buying emerged on January 18, 2026, following reports of potential US tariff measures targeting Denmark’s Greenland territory. The situation escalated when several EU member states reportedly explored retaliatory tariffs on nearly USD 93 billion in US exports. The prospect of an expanded trade conflict triggered another leg higher in the CHF, which strengthened by roughly 0.5% in a single session.

This pattern reinforces a critical point: the CHF responds not only to realized crises but also to anticipatory risk, making it a preferred hedge when geopolitical narratives deteriorate.

US Political Instability Weakens the Dollar’s Safe-Haven Role

While geopolitical risk supports CHF demand, a more structural factor has emerged on the other side of the USD/CHF equation: erosion of confidence in US institutions.

On January 12, 2026, markets were shaken by reports that the US administration had threatened Federal Reserve Chair Jerome Powell with potential criminal charges. This development sent shockwaves through global markets, not because of its legal implications alone, but because it raised fundamental questions about Federal Reserve independence.

Central bank credibility is a cornerstone of reserve currency status. Any perception that monetary policy could be influenced by political pressure undermines trust in the system. Markets responded decisively: the US dollar sold off broadly, while the CHF gained approximately 0.6%, reinforcing its role as an alternative store of value.

This episode did not occur in isolation. By December 22, 2025, the USD had already fallen to a 14-year low against the CHF, signaling that the trend was well established before 2026 began. The Powell incident merely accelerated a move that was already underway.

Yield Differentials No Longer Drive CHF Pricing

Under normal circumstances, widening yield differentials would favor the higher-yielding currency. Yet throughout this CHF rally, US–Swiss yield spreads have moved in favor of the USD, and still the CHF has continued to strengthen.

This divergence highlights a crucial shift in market psychology. Investors are increasingly prioritizing capital preservation, institutional trust, and inflation control over nominal yield. In this environment, the CHF benefits despite Switzerland’s relatively low interest rates.

Concerns around US fiscal sustainability, persistent inflation risks, and political uncertainty have outweighed traditional carry considerations. As a result, the CHF is being treated less as a low-yield funding currency and more as a core defensive asset.

For traders looking to understand this regime shift, it is critical to recognize that CHF strength is not rate-driven—it is confidence-driven.

The Swiss National Bank’s Role and Policy Constraints

The Swiss National Bank (SNB) has historically maintained a cautious stance toward excessive CHF appreciation, given its potential impact on export competitiveness. The SNB retains the option to intervene in FX markets if CHF strength becomes disruptive.

However, as of early 2026, the SNB has largely allowed market forces to operate freely. With Swiss inflation contained and GDP growth projected at around 1.1% for 2026, policymakers appear comfortable tolerating a stronger CHF—at least for now.

This restraint suggests that the SNB recognizes the CHF’s appreciation as a global phenomenon rather than a domestic imbalance. Unless CHF strength accelerates sharply or begins to materially damage economic activity, intervention remains unlikely.

Technical Perspective: USD/CHF Under Pressure

From a technical standpoint, the USD/CHF pair continues to reflect structural weakness.

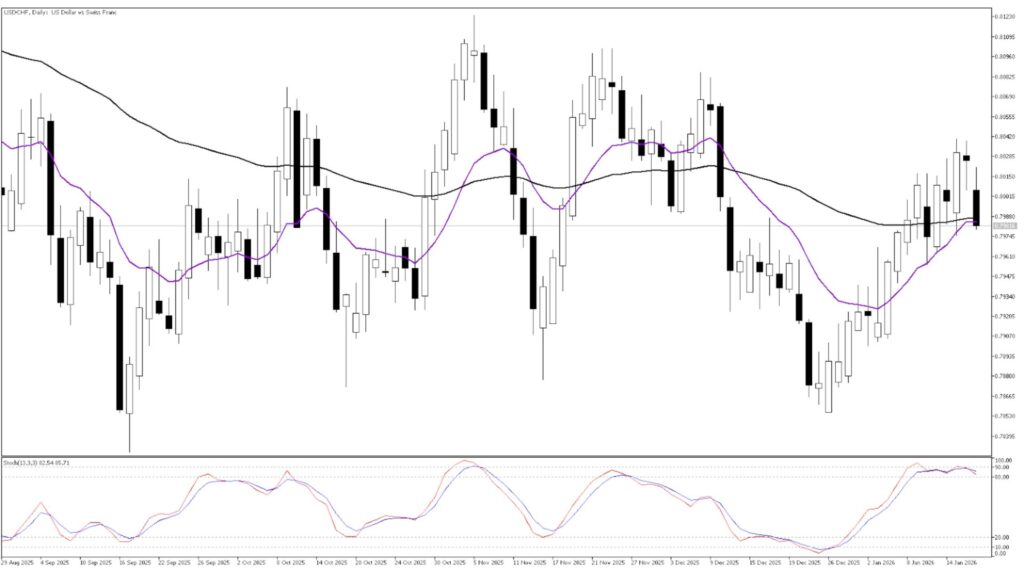

▲USDCHF Daily Chart

The recent recovery attempt has stalled near a long-term moving average, acting as dynamic resistance. Momentum oscillators indicate overextended conditions, suggesting limited upside unless a clear breakout occurs.

If USD/CHF fails to sustain levels above the long-term moving average and closes below the purple moving average near 0.7970, this would confirm a rejection of higher prices. Such a move would likely expose 0.7930 as the next downside test, where the durability of the recent rebound will be assessed.

A sustained break below that level would reinforce the broader bearish trend, while only a decisive reclaim of key resistance zones would challenge the CHF’s dominance.

What This Means for Traders and Investors

For FX participants, the CHF’s strength offers both opportunity and risk. Trend-following strategies continue to favor CHF exposure during periods of elevated uncertainty, while tactical traders should remain alert to short-term corrections driven by positioning or SNB rhetoric.

Those looking to explore CHF-related strategies can learn more about market analysis and macro-driven trading approaches. Practicing CHF trades in a risk-free environment is also possible via a demo account, while experienced traders may consider opening a trading account with Ultima Markets to access global FX markets.

Conclusion

The CHF has emerged as one of the clearest beneficiaries of today’s uncertain macro environment. Fueled by geopolitical tensions, declining confidence in US institutions, and a global preference for stability over yield, the Swiss Franc’s rally appears fundamentally justified.

Unless global risks ease meaningfully or confidence in alternative safe havens is restored, the CHF is likely to remain well supported throughout 2026. For now, Switzerland’s currency continues to represent credibility, neutrality, and financial resilience in a world where those qualities are increasingly scarce.

FAQ

Q1: Why is the CHF considered a safe-haven currency?

The CHF benefits from Switzerland’s political neutrality, strong fiscal position, low inflation, and long-standing institutional credibility.

Q2: Can the Swiss National Bank weaken the CHF?

Yes, the SNB can intervene, but it typically does so only if CHF strength threatens economic stability or export competitiveness.

Q3: Does CHF strength depend on interest rates?

Not primarily. Current CHF demand is driven more by risk aversion and confidence than by yield differentials.

Q4: Is USD/CHF likely to recover in 2026?

A sustained recovery would require reduced geopolitical risk and restored confidence in US institutions—conditions that are not yet in place.

Q5: Is CHF suitable for long-term investors?

CHF exposure is often used as a defensive allocation rather than a high-return investment, particularly during volatile market phases.

This article represents the author’s personal views only and is for reference purposes. It does not constitute any professional advice.