As global markets move into 2026, the dominant macro narrative has undergone a decisive transformation. The once-popular recession thesis is steadily losing traction, replaced by expectations of growth normalization and controlled disinflation. This shift is fundamentally constructive for risk assets—especially U.S. technology equities.

Within this landscape, the NASDAQ 100 stands out as one of the most compelling indices for medium- to long-term positioning. Supported by monetary easing, accelerating AI monetization, and persistent U.S. economic exceptionalism, the NASDAQ 100 appears structurally biased to the upside.

Unless a sudden and deep recession materializes—an outcome current macro and labor data do not support—the path of least resistance for the NASDAQ 100 remains higher.

Macro Regime Shift: From Recession Fear to Growth Normalization

Markets no longer trade on fear of collapse. Instead, investors are increasingly pricing a soft landing—a scenario where inflation cools, growth moderates, and financial conditions remain accommodative enough to support earnings expansion.

This macro regime is historically favorable for equity multiples, particularly in indices dominated by long-duration assets such as the NASDAQ 100. Technology companies tend to benefit disproportionately when growth stabilizes without triggering aggressive policy tightening.

For investors seeking to understand how macro forces interact with index performance, you can learn more about multi-asset macro frameworks and cycle analysis.

The Federal Reserve Path: Why “Insurance Cuts” Matter More Than Aggressive Easing

Rate Stability Is the Real Catalyst

A common misconception is that markets require aggressive rate cuts to rally. In reality, equities often perform best when monetary conditions are no longer restrictive, even if easing is gradual.

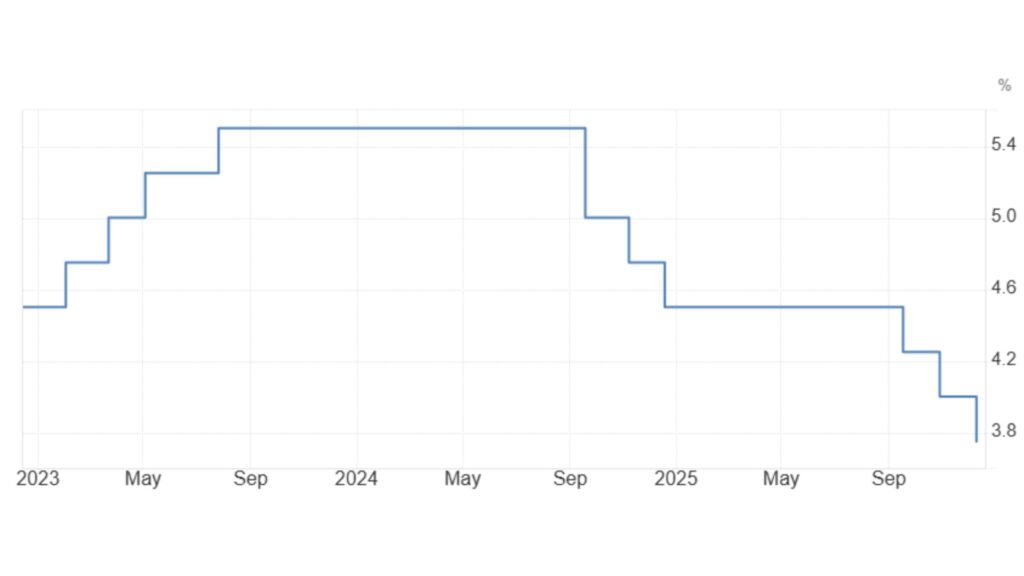

Following the late-2025 rate reductions, the Federal Reserve has shifted into a calibration phase. Market consensus for 2026 suggests an additional 50–75 basis points of easing, bringing policy rates closer to a neutral zone around 3.0%–3.25%.

For the NASDAQ 100, this environment is particularly supportive. Technology stocks are inherently long-duration assets; as the risk-free rate declines, the discounted value of future cash flows rises mechanically.

The Goldilocks Setup for Equities

Crucially, these cuts are not reactive panic moves. They function as “insurance cuts”, intended to preserve expansion rather than rescue a contracting economy. Historical precedents—such as 1995 and 2019—show that equity markets often rally most strongly when the Fed eases while growth remains intact.

This dynamic creates a Goldilocks scenario: inflation contained, growth stable, and financial conditions supportive—an ideal backdrop for the NASDAQ 100.

Technology Earnings Enter the “AI ROI” Phase

From Infrastructure Spending to Revenue Monetization

The technology cycle is evolving. The 2024–2025 phase focused on capital expenditure—data centers, chips, and AI infrastructure. By 2026, the emphasis shifts toward monetization.

Major NASDAQ 100 constituents such as Microsoft, Adobe, and Salesforce are rolling out AI-driven tools that directly enhance productivity and increase average revenue per user. These features are not experimental—they are embedded into enterprise workflows, driving high-margin recurring revenue.

Big Tech as “Yield-Bearing Growth Assets”

Even in a slower-growth environment, NASDAQ 100 heavyweights possess strong balance sheets, substantial cash reserves, and robust free cash flow generation. Increasingly, they resemble yield-bearing growth utilities, capable of compounding earnings at annual rates of 15% or more.

In periods of macro uncertainty, capital tends to concentrate in companies that control their earnings destiny—and that advantage remains firmly with large-cap U.S. technology firms.

U.S. Economic Exceptionalism and the Valuation Premium

Structural Advantages That Persist

Betting against U.S. equities has historically been a losing strategy, and the structural reasons remain intact. The U.S. continues to offer unmatched capital market depth, innovation leadership, and corporate profitability.

The NASDAQ 100 sits at the center of an AI-driven productivity shock, comparable in scale to the internet boom of the late 1990s. Unlike prior cycles, this productivity expansion may raise long-term growth potential without reigniting runaway inflation.

Global Capital Has Few Alternatives

From an allocation perspective, global investors face limited substitutes. Europe struggles with structural stagnation, while China remains difficult for many institutions due to policy and transparency concerns. Against this backdrop, U.S. equities—and especially the NASDAQ 100—justify a persistent valuation premium.

This dynamic reinforces long-term capital inflows into U.S. indices, supporting both earnings growth and multiple expansion.

Key Downside Risk: The Low-Probability Hard Landing

No bullish thesis is complete without acknowledging risk. The constructive outlook for the NASDAQ 100 depends on the soft-landing narrative holding.

A rapid deterioration in the labor market—such as unemployment rising above 5.5%—could materially weaken consumer spending and corporate earnings. In such a scenario, technology valuations would compress, and the NASDAQ 100 could experience a deeper corrective phase.

At present, this risk appears contained. Corporate balance sheets remain healthy, credit stress is limited, and the Federal Reserve retains policy flexibility. The so-called “Fed put” remains credible.

NASDAQ 100 Technical Outlook: Structure Favors Continuation

NASDAQ100, Daily Chart Analysis

Volatility Compression Signals Potential Expansion

From a technical standpoint, the NASDAQ 100 is consolidating near all-time highs within a symmetrical triangle formation. This pattern typically reflects continuation rather than reversal.

The defining feature is volatility compression—shrinking daily ranges often precede sharp directional moves. Given the macro backdrop of easing financial conditions, probabilities favor an upside resolution.

Key Levels for NASDAQ 100 Traders

- 25,800: Short-term resistance; a daily close above confirms bullish breakout

- 26,250: Previous all-time high; first major upside objective

- 25,000: Tactical support zone for buy-the-dip strategies

- 24,000: Structural support and higher-conviction accumulation area

A clean break above 25,800 would likely open the door toward new record highs. Until then, pullbacks toward 25,000 may offer strategic entry points.

For traders looking to practice index strategies in real-market conditions without risk, a demo account can be an effective tool.

Trading the NASDAQ 100 with Discipline

Volatility is likely to persist into early 2026, but with a clear upward bias. Corrections not driven by recession fears should continue to present opportunities rather than threats.

For those seeking direct exposure, opening a trading account with a regulated broker such as Ultima Markets allows access to NASDAQ 100 derivatives alongside comprehensive risk management tools.

Conclusion: “Pause, Not Stop”

The NASDAQ 100 is not signaling exhaustion—it is signaling consolidation. Monetary easing, AI-driven earnings expansion, and U.S. economic leadership form a powerful triad supporting higher prices.

As long as the soft-landing narrative remains intact, the broader trend favors continuation rather than reversal. Whether through breakout strategies above resistance or disciplined accumulation near support, the NASDAQ 100 remains one of the most compelling index opportunities heading into 2026.

FAQ: NASDAQ 100 Outlook

Q1: Why is the NASDAQ 100 expected to outperform in 2026?

Because it combines monetary easing, AI monetization, and U.S. economic exceptionalism—three forces that historically support higher equity valuations.

Q2: How sensitive is the NASDAQ 100 to interest rates?

Highly sensitive. As a long-duration index, lower interest rates increase the present value of future earnings, benefiting technology stocks disproportionately.

Q3: What would invalidate the bullish NASDAQ 100 outlook?

A sharp labor market deterioration leading to a hard economic landing would undermine earnings and compress valuations.

Q4: Is volatility a concern for NASDAQ 100 traders?

Yes, but volatility during consolidation phases often precedes strong directional moves. Risk management remains essential.

This article represents the author’s personal views only and is for reference purposes. It does not constitute any professional advice.