Often referred to as “The Beast,” the British pound has long been infamous for its explosive volatility. Analysts such as Jeremy Ponrajah have repeatedly highlighted one striking characteristic: among all major currencies, sterling exhibits the weakest safe-haven qualities. In times of global stress, the pound tends to suffer, not strengthen — an important distinction when the macro environment begins to deteriorate.

Unfortunately for GBP/USD traders, this is exactly where we stand today.

Across economic fundamentals, policy developments, and capital flow data, a deeply concerning pattern is emerging. The U.K. economy is losing altitude rapidly, structural weaknesses are intensifying, and capital is exiting the country at a pace not seen since the 2008 financial crisis.

Many analysts now believe a decisive bearish break below 1.25 before Q1 2026 is not only possible — but increasingly probable. For traders seeking to understand why, the evidence can be condensed into three powerful forces.

Crumbling Fundamentals: The U.K. Enters a “Nuclear-Level” Recession

Calling the U.K. slowdown “moderate” would be an understatement. The latest data points to a full-blown technical recession already underway.

Growth Engines Stalling Out

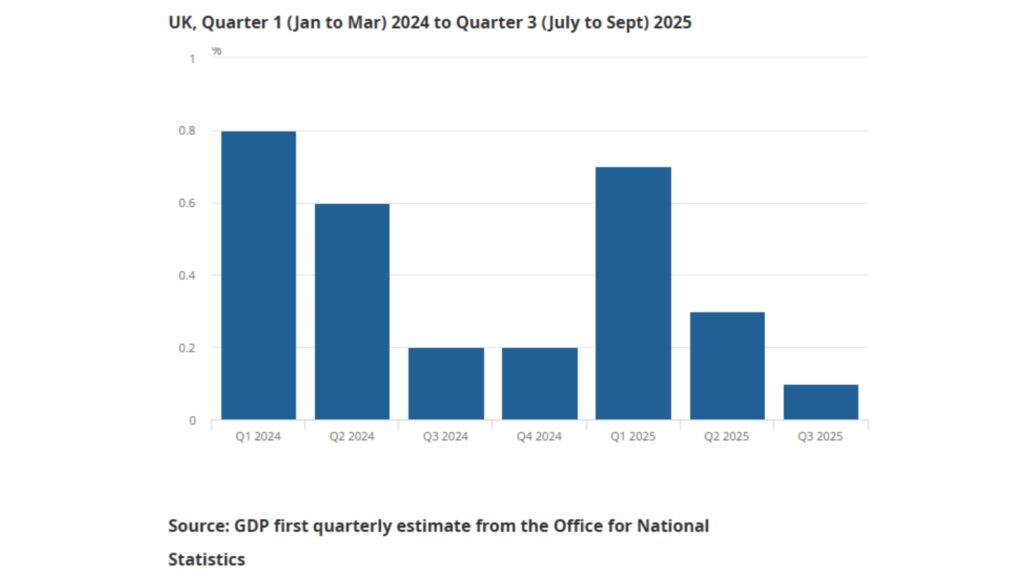

The Office for National Statistics reports that U.K. GDP posted 0% quarter-on-quarter growth in Q3 2025 — effectively flatlining. Beneath that stagnant headline number, domestic demand is collapsing:

- Consumer spending: down 0.3% for two consecutive quarters

- Business investment: plunging 2.1%, its steepest decline in years

For comparison:

- U.S. GDP grew 2.1%

- Eurozone output rose 0.8%

This puts the U.K. at the bottom of the developed-economy rankings, isolated and lagging behind its peers.

The Stagflation Trap Tightens

Even more worrying is the emergence of stagflation — that rare and painful mix of weak growth and sticky inflation.

- Unemployment: spiking to 4.8% (five-year high)

- Core CPI: stuck at 4.5%, stubbornly elevated

This is the Bank of England’s nightmare scenario. Officials have openly acknowledged the rise of a wage-price spiral, hinting that they may face a contradictory policy dilemma: cut rates to support the economy while simultaneously raising rates to tame inflation.

As contradictions pile up, GBP/USD weakens further.

Policy Shockwaves: Tariffs Trigger a Full-Scale Trade Crisis

If falling domestic demand represents a chronic condition, then the U.K.’s trade developments are an acute shock — and a dangerous one.

U.S. Tariffs Hit the U.K.’s Core Industries

New “reciprocal tariff” measures targeting U.K. manufacturing took effect on April 2nd:

- Automobiles: 25% tariff

- Pharmaceuticals: 30% tariff

The damage was immediate. In September alone:

- U.K. exports to the U.S. collapsed by 18% YoY

- Automotive PMI plunged to 40.2, its worst reading since 1990

These industries represent the backbone of U.K. manufacturing — and both are under direct fire.

EU Retaliation Makes a Bad Situation Worse

Brussels responded with its own wave of tariffs:

- 15% tariff on British steel

- Export costs surged 22%

The U.K. steelworkers’ union has warned that mass layoffs could begin in 2026, adding a new layer of social and economic instability.

The combined U.S.–EU pressure creates an unprecedented external shock to the U.K.’s already fragile production ecosystem. For a currency like GBP — highly sensitive to trade flows — the implications are unmistakably bearish.

The Great Capital Flight: Investors Are Abandoning the U.K.

Perhaps the most alarming signal comes from capital flows — historically one of the strongest determinants of pound strength.

Mounting Fiscal Stress Pushes Investors Away

The U.K.’s 2025 fiscal deficit has ballooned to 5.8% of GDP, well above the EU’s 3% guideline. Bond investors have reacted sharply:

- 10-year gilt yields surged to 4.8%

- Spread over German bunds widened to 250 bps

Deutsche Bank has even warned that gilts could face a downgrade to junk territory.

To contain inflation and stabilize debt, the Treasury announced £6 billion in welfare cuts, a move expected to further depress already-weak consumer spending.

Capital Outflows Reach Crisis Levels

According to London Stock Exchange data:

- £18.7 billion in net foreign outflows hit the U.K. equity market in October

- BlackRock and Vanguard both reduced holdings in British financial stocks

- U.S. and European markets saw net inflows over the same period

Corporate capital is fleeing as well:

- GlaxoSmithKline moved key operations to Switzerland

- AstraZeneca shifted production to Singapore

The British Chambers of Commerce has issued a stark warning:

A “corporate exodus tsunami” could strike in 2026.

This is one of the clearest bearish signals for GBP/USD. When both portfolio capital and corporate investment leave a country, the currency rarely fares well.

Trading Outlook: Technical Breakdown Confirms the Bearish Case

Fundamentals may be deteriorating rapidly, but the charts tell an equally troubling story.

A Multi-Timeframe Breakdown Is Underway

On the monthly MACD, GBP/USD has formed a confirmed death cross — a long-term bearish indicator that historically signals multi-month downtrends.

After the break below 1.34 in April 2025, the pair established a descending-triangle pattern, a classic bearish continuation signal.

The next major level sits at:

- 1.2380 — the pandemic low from 2020

A violation of this level could unleash algorithmic selling and cascade into a deeper bearish wave.

Crowded Long Positions Pose Severe Reversal Risk

CFTC data reveals a contrarian warning:

- Leveraged funds are holding 34-month-high net-long positions in GBP

Such one-sided positioning often precedes violent reversals. Once these longs panic-exit, the downside momentum can accelerate dramatically.

Strategy Guide: How Traders Can Approach the GBP/USD Downtrend

Depending on risk appetite and trading style, market participants may approach the developing downtrend in different ways.

(For new traders looking to practice market setups safely, a free demo account from Ultima Markets can help simulate GBP/USD conditions without risk.)

A. Futures & Spot Traders

A tactical approach:

- Consider short entries near 1.31436

- Target zone: 1.28500

- Expect short-term volatility if the Bank of England intervenes (rumors suggest a £20 billion program)

However, such interventions typically create better selling opportunities, not sustainable reversals.

B. ETF Traders

Sterling-bear ETFs (including inverse or leveraged inverse options like shorting FXB) may offer downside exposure.

C. Risk Management Reminder

A highly dovish Bank of England statement in December could trigger a temporary GBP/USD rally. But mid-term direction remains firmly downward as long as the U.K. faces:

- A hard economic landing

- A widening trade deficit

- Mounting fiscal pressure

- Accelerating capital flight

Those structural forces are not easily reversed.

For traders ready to transition from analysis into execution, a live trading account allows direct access to GBP/USD movements with professional-grade tools.

Conclusion

The British pound is entering one of the most dangerous phases in its modern history. Economic deterioration, policy shocks, and unprecedented capital outflows are aligning into a powerful bearish force — a “perfect storm” that few currencies could hope to survive unscathed.

While short-term volatility may occur, the medium-term trajectory for GBP/USD remains heavily tilted to the downside. For traders, this is a market that demands preparation, caution, and disciplined execution.

FAQ

1. Why is GBP/USD considered highly volatile?

The pound lacks safe-haven characteristics and reacts strongly to global risk sentiment, making movements sharper than other major currency pairs.

2. What is causing the current weakness in the British pound?

A combination of recessionary conditions, stagflation, tariff shocks, and massive capital outflows are exerting heavy downward pressure.

3. Could Bank of England intervention stop the decline?

Interventions may slow volatility temporarily but typically offer better selling opportunities rather than reversing long-term bearish trends.

4. What key levels should traders watch?

The major support to monitor is 1.2380. A decisive break could accelerate the downtrend significantly.

5. How can beginners practice GBP/USD trading?

New traders can use a free demo account to test strategies in a risk-free environment.

This article represents the author’s personal views only and is for reference purposes. It does not constitute any professional advice.