In today’s fast-evolving financial landscape, growing your wealth no longer relies solely on clocking long work hours. As we enter 2026, more individuals are turning to strategies that allow their money to multiply with minimal ongoing effort. Passive income ideas have become a core part of modern wealth-building, offering people a path toward financial security, independence, and a more flexible lifestyle.

Whether you are completely new to investing or already comfortable navigating financial markets, understanding how passive income works—and which methods truly deliver—can help you stay resilient in an unpredictable global economy.

What Passive Income Really Means

Passive income refers to earnings generated from assets, systems, or products that continue producing revenue after the initial setup. Unlike active income, where you exchange time for money, passive income allows you to maintain cash flow with limited ongoing involvement.

Common examples include dividends, royalties, rental income, digital products, and investments that grow automatically through compounding or automation tools.

As noted by various finance publications such as Forbes, successful wealthy individuals often combine several passive income streams to reduce risk and create long-term stability.

Why Passive Income Is Essential in 2026

A combination of economic, technological, and lifestyle shifts has made passive income more important than ever:

- Economic volatility has pushed more people to seek alternative income sources.

- Automation and AI tools make it easier to set up income streams that run 24/7.

- Global investment platforms like Ultima Markets enable beginners to access multiple markets from a single account.

- High inflation motivates individuals to pursue income sources that outpace rising costs.

In 2026, diversifying your income is no longer just a personal goal—it’s becoming a strategic necessity for long-term financial resilience.

Top Passive Income Ideas for 2026

Below are some of the most relevant, practical, and scalable passive income opportunities that investors are exploring this year. These ideas reflect the expanding role of fintech, digital entrepreneurship, and automated investing.

1. Dividend-Paying Investments

Dividend investing remains one of the most dependable passive income ideas. When you purchase shares of companies with strong financial track records, they distribute part of their profits to shareholders in the form of dividends.

Example:

Holding blue-chip stocks or ETFs that provide steady quarterly dividends.

Why it works:

Dividends offer consistent cash flow, but the real power lies in reinvesting them—allowing your wealth to grow through compounding while also benefiting from long-term capital appreciation.

2. Real Estate Crowdfunding

Real estate has always been a proven wealth-building vehicle. However, rather than purchasing an entire property, modern crowdfunding platforms allow investors to contribute smaller amounts to large real estate projects.

Example:

Participating in crowdfunding pools that invest in rental units or commercial real estate.

Why it works:

You earn returns from rental income and property appreciation, while property management professionals take care of daily operations.

3. High-Yield Savings Products and Bonds

While traditionally seen as low-risk, low-reward, fixed-income products still play a crucial role in diversified passive income strategies.

Example:

Government bonds, money market funds, or inflation-indexed securities.

Why it works:

These assets offer predictable returns with very little risk—ideal for conservative investors or those seeking stable backup income streams.

4. Affiliate Marketing

This passive income method is popular among content creators and marketers. With affiliate marketing, you earn commissions by recommending products or services online.

Example:

Publishing product comparisons, blog reviews, or tutorial videos with affiliate links.

Why it works:

Once your content gains traction or ranks on search engines, it can generate revenue long after being published.

5. Peer-to-Peer (P2P) Lending

Fintech platforms have transformed the lending market by allowing individuals to loan money directly to borrowers and earn interest in return.

Example:

Joining P2P networks that match investors with verified borrowers.

Why it works:

P2P lending may offer higher returns than traditional savings products while providing diversification in your income sources.

6. Selling Digital Products or Courses

Digital assets are becoming one of the fastest-scaling passive income ideas, especially with global demand for online education and downloadable materials.

Example:

Publishing an e-book, selling design templates, or launching a full-length online course—such as one on trading or investing.

Why it works:

Digital goods require upfront effort but can generate ongoing revenue without the need for physical inventory or logistics.

7. Forex Trading and Copy Trading Automation

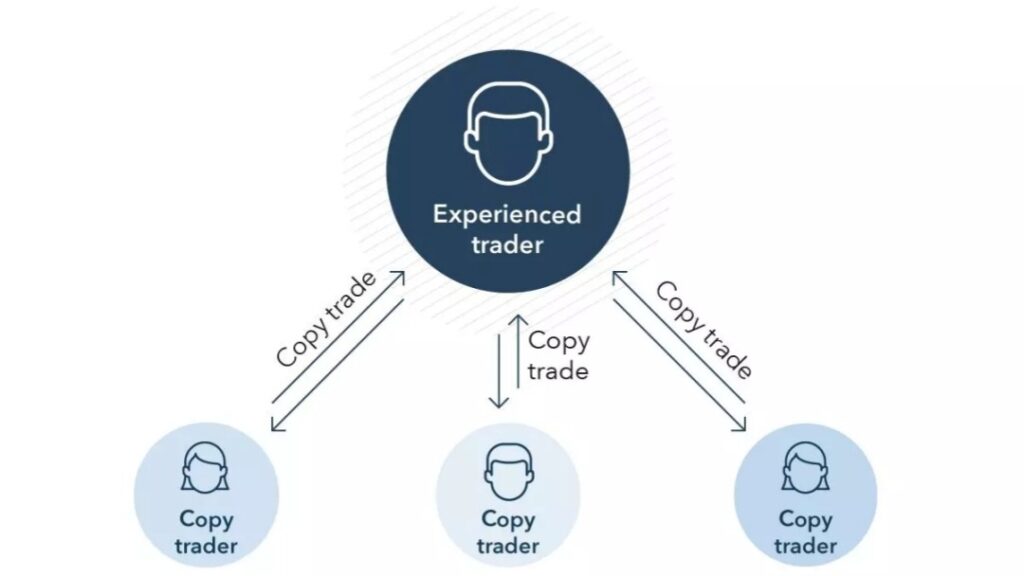

With the growth of advanced trading platforms like Ultima Markets, investors now have access to tools that make forex trading more accessible and semi-automated. Copy trading, in particular, allows users to replicate professional traders’ strategies automatically.

Example:

Connecting your trading account to a verified expert whose trades execute in real time on your behalf.

Why it works:

You can participate in global Forex currency markets without constant monitoring—ideal for newer traders who want exposure but lack experience.

Beginners may also practice using a demo account before going live.

8. REITs (Real Estate Investment Trusts)

For those who want real estate exposure without property management responsibilities, REITs offer a structured, hands-off option.

Example:

Buying shares of REITs that focus on apartments, retail spaces, hospitality, or data centers.

Why it works:

REITs distribute a major portion of their profits as dividends, providing reliable income while staying highly liquid.

9. Selling Creative Assets or Stock Photos

Artists, photographers, and musicians can turn their creativity into recurring revenue by licensing their work online.

Example:

Listing stock photos, illustrations, or audio tracks on royalty-based platforms.

Why it works:

Once uploaded, your creative assets continue generating downloads and royalties.

10. Automated E-Commerce

Modern e-commerce systems allow entrepreneurs to run online stores without directly handling inventory.

Example:

Launching a dropshipping or print-on-demand store where fulfillment is managed by external suppliers.

Why it works:

Automation tools handle payments, shipping, and customer service, allowing the business to function with minimal intervention.

How to Pick the Passive Income Idea That Fits You

Every passive income method carries different levels of risk, effort, and capital requirements. Choosing the right one depends on your financial goals and personal strengths.

Key considerations include:

- Initial investment requirement:

Some methods require significant capital (e.g., crowdfunding), while others rely more on creativity (e.g., digital products). - Risk tolerance:

Assess how much volatility you’re comfortable with. - Your skill set:

Leverage what you’re already good at to accelerate results. - Time commitment:

Passive income grows over months or years, not overnight.

Successful investors often combine multiple streams—mixing low-risk options like bonds or REITs with higher-growth ideas such as digital products or forex strategies.

Building Long-Term Passive Income in 2026

Treat passive income like a structured, ongoing project rather than a one-time initiative. Sustainable wealth is created through consistency, discipline, and informed decision-making.

Steps to build lasting passive income:

- Set clear financial goals

Define what you want to earn in the next 6–12 months. - Automate your reinvestments

Use tools that reinvest dividends, interest, or trading gains automatically. - Diversify your portfolio

Spread your investments across multiple asset classes. - Continue learning

Read credible sources such as Forbes, Business Insider, and professional trading platforms. - Monitor performance

Review your logs monthly and adjust strategies as needed.

Those who focus on strategic diversification and continuous improvement will be well-positioned to thrive financially throughout 2026.

Conclusion

Building passive income isn’t about taking shortcuts—it’s about creating systems that work for you over time. The best passive income ideas for 2026 empower investors from all backgrounds to strengthen financial stability, reduce dependency on a single paycheck, and unlock new opportunities for long-term prosperity.

Key Takeaways

- Passive income helps build financial resilience and independence.

- Great beginner-friendly ideas include affiliate marketing, dividend stocks, REITs, and digital products.

- 2026 introduces more tech-driven opportunities such as automation and copy trading.

- Education, patience, and diversification are essential for sustainable success.

- Tools from platforms like Ultima Markets make it easier to explore multiple asset classes with confidence.

As Warren Buffett famously said:

“If you don’t find a way to make money while you sleep, you will work until you die.”

Start building systems today, and let 2026 be the year your money begins working harder than you do.

FAQ

1. What is the easiest passive income idea for beginners?

Affiliate marketing, dividend ETFs, and selling simple digital products are among the most beginner-friendly options due to their low initial cost.

2. Can passive income really replace my full-time job?

Yes—but it typically takes consistent investment, reinvestment, and multiple income streams to reach full income replacement.

3. How much money do I need to start investing?

Some options require as little as $10 (e.g., ETFs or fractional shares), while others like real estate crowdfunding may require more substantial capital.

4. Is forex copy trading a safe passive income method?

Copy trading can be helpful for beginners, but results depend on market conditions and the trader you follow. Practicing first with a demo account is recommended.

5. How long does passive income take to build?

Most passive income streams take weeks to months before producing noticeable returns. Long-term consistency is key.

This article represents the author’s personal views only and is for reference purposes. It does not constitute any professional advice.